COVID-19 Pandemic Timeline

Year 2020 might be one of the most unforgettable years by most people worldwide. The COVID-19 virus outbreak has led to a total disaster in many countries. It all started at the very end of, on 31 December 2019, China’s government alerted World Health Organization (WHO) on their finding to 40 pneumonia alike cases from an unknown virus in Wuhan, Hubei (Figure 1). On 7 January 2020, officials announced that they already identified a new virus named 2019-nCovid and was classified as coronavirus family, which includes seasonal flu and SARS. On 13 January 2020, the first case outside China was reported in Thailand from a woman who had just come back from Wuhan. The number of confirmed cases kept rising both in China and overseas, which made the WHO declared the coronavirus as a global emergency on 30 January 2020. Many countries started to lock down their infected cities, suspend all activities and impose a strict quarantine to slower the virus spreading. On 20-24 February 2020, the Middle East especially Kuwait, Bahrain, Iraq, Iran, Afghanistan, and Oman all reported their first cases of the virus. Finally, on 11 March 2020, WHO declared the COVID-19 outbreak as a global pandemic, by that time, there had been more than 118,000 cases with 4,291 death distributed into 114 various countries (WHO, 2020).

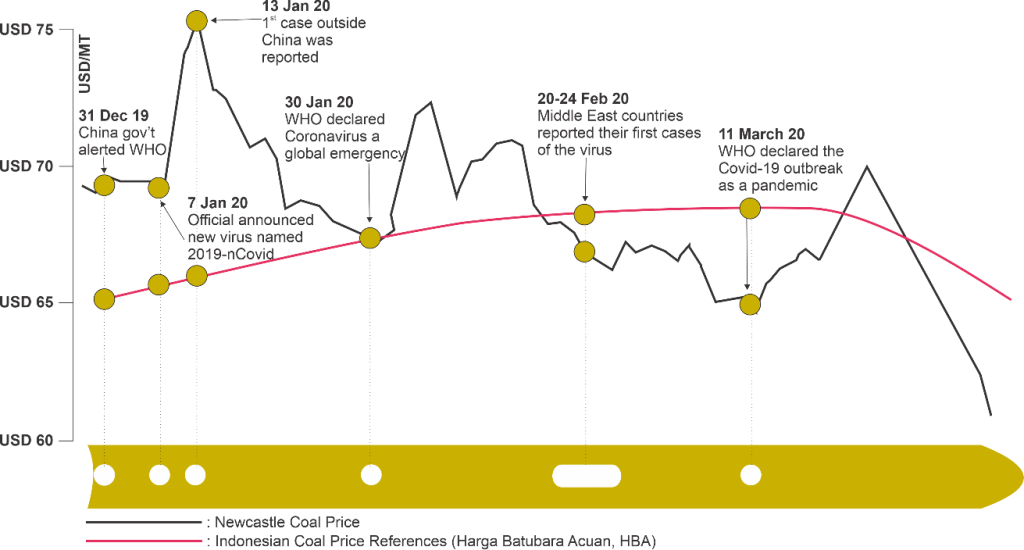

Figure 1. COVID-19 timeline related to the global energy sector.

The Threat of Global Economic Crisis

Global economic crisis is inevitable as the COVID-19 virus outbreak has forced many strategic sectors to their lowest level. China has been the leading manufacturing country for decades which shared 20% of total global manufacturing output in 2015 (West & Lansang, 2018). Wuhan, where the virus first detected, is one of China’s largest cities, with the highest population and biggest industrial hubs.

Businesses in surrounding Hubei areas were limiting their activities or shutting down temporarily to slower the virus spreading. This definitely gave a ripple effect to the global supply chain worldwide. As the virus traveled outside China, the major panic in the market started to happen and some experts likened it to the 2008 economic crisis. The crisis followed by a plunging stock market and the threat of recession which caused the government in many countries to lower interest rates and give stimulus to prevent the financial crisis. For example, in Indonesia, Bank Indonesia as the central bank decided to reduce the interest rates to 4.5%, deposit facility interest rates to 3.75% and lending facility to 5.25% as the stimulus (Karunia, 2020).

Industries tied to travel and tourism such as airlines, cruise lines, and hotels are the first to take-up the hit during outbreak due to the travel bans. Many industries in this sector set 2020 goals to only survive the crisis, let alone to increase their revenue growth. Energy industries are in no better shape either, although they vary among each type of energy.

Coal Market

Figure 2. Correlation between coal price fluctuation and COVID-19 timeline (processed from Trading Economics, 2020 and MEMR, 2020)

In 2019, coal accounted for 57.7% of China’s primary energy consumption, especially for the power generation sector (Daly & Zhang, 2020). As mentioned above, the COVID-19 outbreak has impacted China’s economic activity, resulting in decreasing power and energy demand. The power demand decreases usually linked to the drop in the coal price. Newcastle coal has shown trend decreases since mid-2019 and continued in early 2020 as shown by the black line in Figure 1, but this was unlikely linked to the COVID-19 outbreak. The price drop was caused by the weakening demand prospect in the US and Europe as well as China’s coal import restriction for Australia’s coal. The impact of COVID-19 on the Newcastle coal has just begun in the last March 2020. On the other hand, the red line in Figure 1 shows that in the first quarter of 2020, the Indonesia’s benchmark thermal coal price(Harga Batubara Acuan, HBA) was rising which might be caused by the supply decreases from Australia and China. In Australia, the bushfire crisis hampered coal production, and at the same time, China’s government extended the Chinese New Year public holiday to slow the virus spread which led to a coal production delay. The coal consumption, however, was still in high demand as it was the coldest month of the year especially in China, Japan, and South Korea. Although news already reported that there are already some delays on coal loadings from Indonesia, press releases from the Ministry of Energy and Mineral Resources (MEMR) in February 2020 also insisted that the COVID-19 outbreak has not created a significant impact on Indonesia’s coal sector. It is because the Indonesia’s coals have been utilized as an electricity supply rather than industrial commodities (MEMR, 2020). However, in April 2020, China’s coal production has already recovered steadily post the lunar holidays, while electricity demand keeps decreasing as the COVID-19 has spread to many more countries. This leads to the coal oversupply which causes the decreases in coal price.

Oil Market

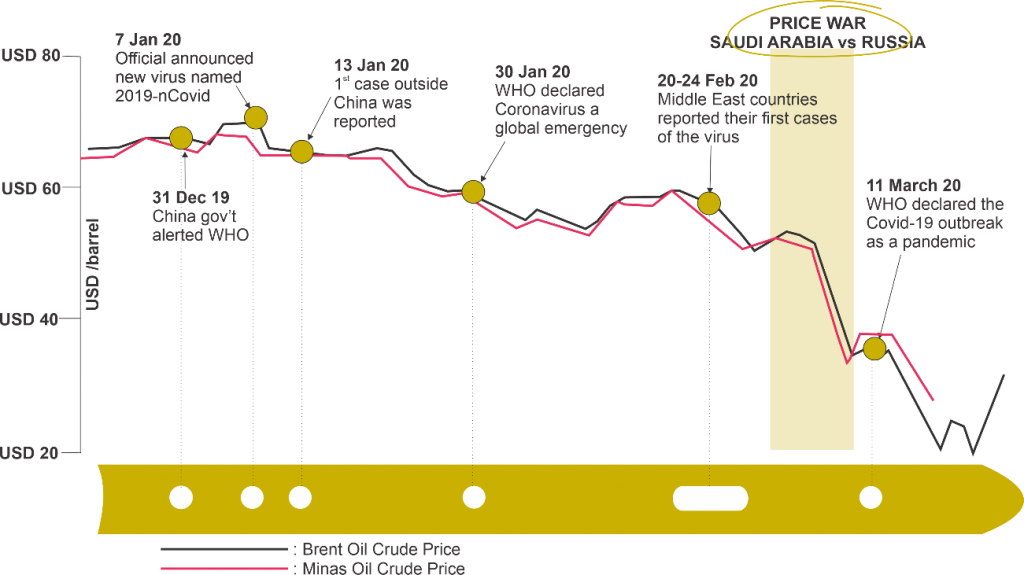

Figure 3. Correlation between crude oil price fluctuation and COVID-19 timeline (processed from Trading Economics, 2020)

Unlike coal, oil commodity seems to be more severely affected by COVID-19 outbreak. Most of the oil commodity is consumed for transportation fuels and industrial feedstocks, and in 2019, China accounted for more than 80% of global oil demand growth. The implementation of global travel restriction, physical distancing, and several lockdown policies have put the oil demand to decrease sharply. According to IEA, currently, the global oil demand is down by around 90,000 barrels per day from 2019. This is becoming the first drop in oil demand since 2009 (IEA, 2020). Figure 2 shows the continuous dropped of the oil price since the first COVID-19 case in China. The decreases started to appear after the first case of COVID-19 was reported outside China. The price keeps dropping as the outbreak spreads throughout the world especially after the WHO increases the COVID-19 outbreak status on 30 January 2020 and 11 March 2020. The rapid decrease also occurred when the COVID-19 had reached the Middle East, one of the biggest oil producer areas. However, instead of the COVID-19 outbreak, the major cause of oil price drop is arisen due to the price war between Saudi Arabia and Russia. Russia’s refusal to slash production during a meeting with the Organization of the Petroleum Exporting Countries (OPEC) in Vienna on 6 March 2020 was responded by Saudi Arabia with the discounted oil price and increased oil production. Shortly after Saudi Arabia increased its oil production by 25%, Russia added oil production to 500,000 barrels per day (The Economist, 2020). The oil price had its biggest one-day crash since the 1991 Gulf War as the COVID-19 outbreak has dropped the oil demand while both Saudi Arabia and Russia keep supplying the market with more oil. According to Goldman Sachs, the oil price could hit USD 20 per barrel (Al Jazeera, 2020). On 2 April, after almost a month of the price war, oil price surged more than 20% after US President stated that Russia and Saudi Arabia planned to end their price war by slashing output. However, the oil price might only fluctuate around USD 30 per barrel as the COVID-19 outbreak still disrupt oil demand worldwide. Many oil-exporting countries are suffered from the low oil price, as not many oil producers could produce oil with such low oil prices. Countries such as Venezuela, which has oil cost of production around USD 20 per barrel, is struggling even only to cover the operating costs. Indonesia’s oil sector, especially in the upstream, will be affected by this situation. There might be a delay in the exploration and production projects. The oil downstream sector will also be distressed by the crisis as the fuel demand significantly dropped. On the other hand, the state budget will be benefited as we relied on the oil import to fulfill our domestic oil demand. Thus, the fuel import and subsidy budget will be reduced significantly as both the oil price and oil consumption decrease.

Natural Gas

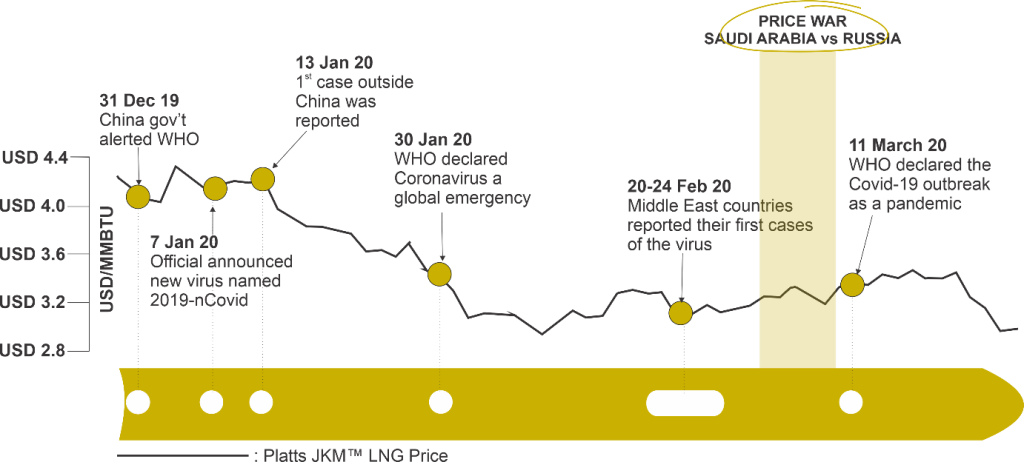

Figure 4. Correlation between natural gas price fluctuation and COVID-19 timeline (Source: processed from Trading Economics, 2020)

Natural gas price is determined not only by supply-demand but also the fluctuation of oil prices. The COVID-19 outbreak has disturbed the LNG demand especially in the main growing market such as China. However, the volatility of gas price especially the LNG spot price is expected to happen due to the oil price decrease factor rather than a supply-demand factor. LNG price could be divided into two types, a long-term contract which usually takes around 10 years contract and the short-term contract or commonly known as the spot price. Currently, roughly 70-75% of the LNG market is still sold under long-term contracts indexed to oil which is not directly affected by the dropped of oil price (Eric Yep, 2020). However, if the low oil price persists for a longer period, the long-term LNG contract will be impacted especially for the contracts that are set to expire between 2020 and 2021.

On the other hand, the drop in oil price will affect the spot LNG price depending on how long the low oil price persists. Figure 4 shows the Platt Japan Korea Marker (JKM) spot price fluctuation which becomes the benchmark for LNG spot price deliveries to North-East Asia including Japan, South Korea, and China. JKM has reached an all-time low of USD 2.7 per MMBTU and been expected to keep falling if the oil price remains at a very low price.

Most of Indonesia’s LNG commodity is exported based on the long-term contract which as previously mentioned is not highly affected by the short fluctuation of oil price. The oil price decrease has narrowed the gap price between the long-term LNG contract price and LNG spot price. It should also be noticed that some importers are already rethinking to exercise termination clauses in their long-term contracts.

Renewable Energy

Figure 5. Solar module producer by countries (Bloomberg News, 2020)

Renewable Energy (RE) has different issues compared to other types of energy regarding its impact by the COVID-19 outbreak. As previously mentioned, the COVID-19 outbreak has disrupted China’s manufacturing industries sector including RE. Figure 5 shows the domination of China as the biggest solar module producing country. This has brought uncertainty to the supply chain of RE especially wind and solar. Most RE suppliers have provided force majeure notices to their developers which causes delays on construction timelines and financings. In the case of solar panels, although many manufacturers are located outside China including Indonesia, the raw materials such as back sheets and junction boxes are still sourced from China. Thus, it is likely that the RE capacity target for 2020 is difficult to be achieved by most of the countries. However, the delays may just come in the Q3 or Q4 of 2020 as most manufacturers already shipped most of the products for the early 2020 projects. In the long run, RE development in the demand side could still experience a crisis if low fossil energy prices last for a longer time. This will make RE less competitive and a threat to the energy transition initiative. On the other hand, on the supply side, there might be a good opportunity to expand the business as the low oil price has successfully made RE project investment become more attractive by promising higher rates of return (RoR) than upstream oil and gas. This could be a silver lining for RE investment in Indonesia which has been slowing down significantly since 2018 as shown in Figure 6.

Figure 6. Indonesia renewable energy investment (Purnomo Yusgiantoro Center (PYC), 2019)

Conclusion

The COVID-19 outbreak has certainly brought a sudden energy demand destruction throughout the world. The hardest-hit came from oil commodity as it is mostly related to transportation fuel and industry products. The travel restriction and business activities limitation drag oil prices to the low level due to the oversupply. Furthermore, the price war between Saudi Arabia and Russia brings the oil price to below USD 30 per barrel which is the lowest price within the last two decades.

On the other hand, the other energy commodities such as coal and natural gas are yet to be impacted by the COVID-19 outbreak in early March 2020. However, in April 2020 as China’s coal production has recovered while the COVID-19 spreads continuous, the coal oversupply and price decrease has started to appear. On the other hand, LNG price is still maintained as a result of the long-term contract scheme.

Unlike fossil energy, RE demand is not affected by the temporary disruption such as the COVID-19 outbreak. However, as the outbreak impacts China, the biggest manufacturing country in RE, it impacts the supply chain of the RE technology worldwide. Overall, the full effect of the COVID-19 has yet to be seen for coal, gas, and RE.

In the short run, Indonesia’s energy sector is benefited by the COVID-19 outbreak as the oil price decreases while coal and LNG price remain stable. This will help to restore the state budget which is usually burdened by the fuel subsidy. Most of Indonesia’s coal and LNG products are exported to Asian countries especially China, India, Japan, South Korea, and Taiwan. Thus, the future of Indonesia’s coal and LNG market will highly dependent on those countries, how fast they can recover from the outbreak.

RE business is experiencing a lack of technology supply, this should not last for a longer time as China has started to recover from the pandemic. The drop in oil price threatens the RE industry and it can hinder the energy transition agenda. However, the low oil price could also become opportunities as it makes the RE industry become an attractive business for investors. The supporting regulations which consider all the factors above could help this crisis became opportunities rather than a threat to RE development.

References

Al Jazeera. (2020, March 15). What’s behind Saudi Arabia’s oil price war with Russia? Retrieved from Al Jazeera: https://www.aljazeera.com/programmes/countingthecost/2020/03/saudi-arabia-oil-price-war-russia-200315114308947.html

Bloomberg News. (2020, February 27). Coronavirus Is Starting to Slow the Solar Energy Revolution. Retrieved from Bloomberg: https://www.bloomberg.com/news/articles/2020-02-27/coronavirus-is-starting-to-slow-the-solar-energy-revolution

Daly, T., & Zhang, M. (2020, February 27). Coal’s share of China energy mix falls in 2019 but consumption still rising. Retrieved from Nasdaq: https://www.nasdaq.com/articles/coals-share-of-china-energy-mix-falls-in-2019-but-consumption-still-rising-2020-02-27

Eric Yep, S. M. (2020, March 9). Oil price crash to reverberate through LNG markets. Retrieved from S&P Global: https://www.spglobal.com/platts/en/market-insights/latest-news/natural-gas/030920-oil-price-crash-to-reverberate-through-lng-markets

Frankfurt School of Finance & Management. (2019). Global Trends in Renewable Energy Investment 2019. Frankfurt: Frankfurt School of Finance & Management.

IEA. (2020, March 9). Global oil demand to decline in 2020 as coronavirus weighs heavily on markets. Retrieved from IEA: https://www.iea.org/news/global-oil-demand-to-decline-in-2020-as-coronavirus-weighs-heavily-on-markets

Karunia, A. M. (2020, March 19). Lagi, BI Turunkan Suku Bunga Acuan. Retrieved from Kompas.com: https://money.kompas.com/read/2020/03/19/143509326/lagi-bi-turunkan-suku-bunga-acuan

MEMR. (2020, March 24). Harga Batu Bara Acuan. Retrieved from https://hba.minerba.esdm.go.id/if_home

MEMR. (2020, February 12). Press Release: Corona Virus Does Not Affect Coal. Retrieved from MEMR: https://www.esdm.goa.id/en/media-center/news-archives/ancaman-corona-tak-pengaruhi-komoditas-batubara

PYC. (2019). PYC Indonesia Renewable Energy Booklet. Jakarta: Purnomo Yusgiantoro Center.

The Economist. (2020, March 12). No one is likely to win the oil-price war. Retrieved from The Economist: https://www.economist.com/finance-and-economics/2020/03/12/no-one-is-likely-to-win-the-oil-price-war

The Jakarta Post. (2020, March 16). Energy Ministry may lower coal production target as Chinese demand falls. Retrieved from The Jakarta Post: https://www.thejakartapost.com/news/2020/03/16/energy-ministry-may-lower-coal-production-target-as-chinese-demand-falls.html

Trading Economics. (2020). Coal. Retrieved from Trading Economics: https://tradingeconomics.com/commodity/coal

Trading Economics. (2020). Crude Oil. Retrieved from Trading Economics: https://tradingeconomics.com/commodity/crude-oil

Trading Economics. (2020). Natural Gas. Retrieved from Trading Economics: https://tradingeconomics.com/commodity/natural-gas

West, D. M., & Lansang, C. (2018, July 2018). Global manufacturing scorecard: How the US compares to 18 other nations. Retrieved from Brookings: https://www.brookings.edu/research/global-manufacturing-scorecard-how-the-us-compares-to-18-other-nations/

WHO. (2020, March 11). WHO Director-General’s opening remarks at the media briefing on COVID-19 – 11 March 2020. Retrieved from WHO: https://www.who.int/dg/speeches/detail/who-director-general-s-opening-remarks-at-the-media-briefing-on-covid-19—11-march-2020

*This opinion piece is the author(s) own and does not necessarily represent opinions of the Purnomo Yusgiantoro Center (PYC)